The 90-Day Value Sprint

Budgets are tight, scrutiny is high. The fastest wins this year come from fixing where dollars stall—not from bigger headcount or endless diagnostics. Our 90-day pattern focuses on 3–5 levers that move cash and capacity quickly.

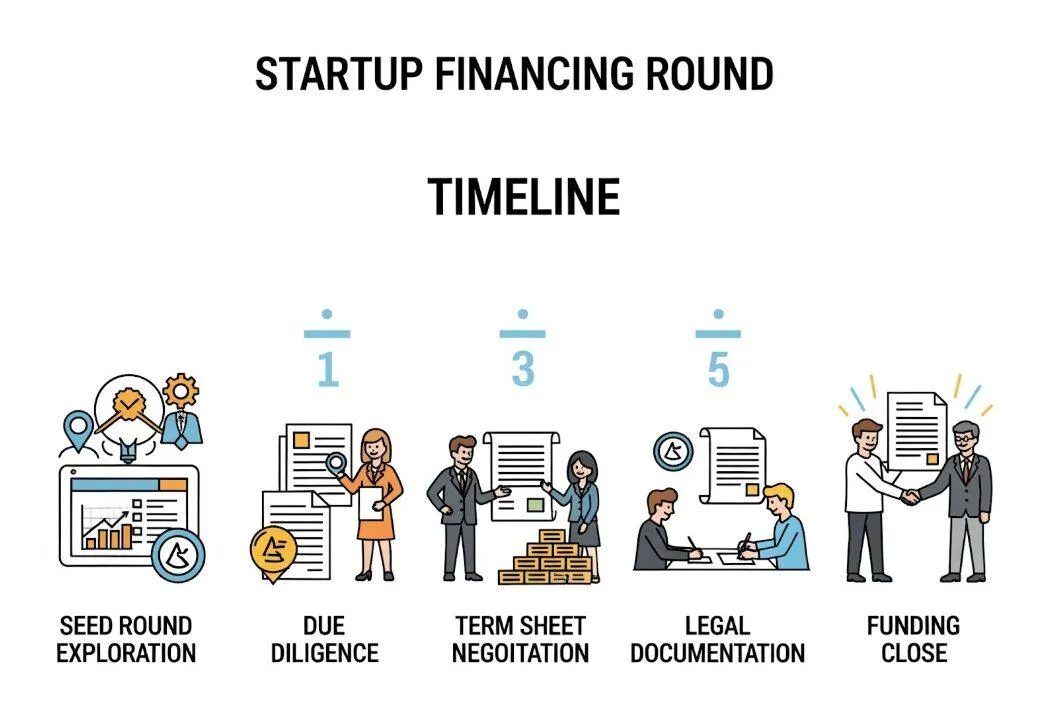

Weeks 0–1 — Outcome lock-in (with Finance)

Pick one measurable business outcome

(e.g., “Shorten quote-to-cash by 10 days”).

Agree on acceptance criteria and a simple R/Y/G

dashboard before kickoff.

Weeks 2–4 — Friction map

Trace where value leaks:

lead→opportunity, quote→cash, ticket→resolution.

Instrument only 3–5 signals you’ll actually use.

Weeks 5–8 — Ship 2–3 interventions

Tighten pipeline rules & handoffs.

Standardize pricing/approvals and e-sign.

Add self-serve for the obvious support intents (keep NPS level).

Weeks 9–12 — Close the loop

Publish before/after with Finance.

Decide: scale, shelve, or swap.

If scaling, lock a run-rate impact and next milestone.

Three levers we’re deploying now

Pipeline rules > headcount

Define stage entry/exit, SLA handoffs, and auto-aging. Expect cleaner forecasts and faster cycle time without adding SDRs.

Quote-to-cash cleanup

Standard SKUs/pricing, auto-approval thresholds, e-sign, and invoice triggers tied to milestone completion.

Self-serve where customers want it

Route the top ten intents to guided self-serve; keep complex cases human. Measure deflection and satisfaction.

Signals to watch

Cycle time (lead→opportunity; quote→cash; ticket→resolution)

Stage conversion (by ICP) and forecast accuracy

First-contact resolution / deflection rate (with NPS)

Time-to-invoice and DSO

CoreScale provides advisory and execution support; final decisions (including legal/compliance) remain with your organization. No outcomes are guaranteed. Governing law: Nevada.

COMPANY

WORK WITH US

LEGAL

Disclosure: CoreScale Partners is not a licensed broker, dealer, or legal advisor. We do not act in any fiduciary or legal capacity. All services are strictly consultative in nature. For more information, please see our Terms & Conditions and Privacy Policy.

© Copyright 2025. CoreScale Partners. All Rights Reserved.